Everywhere you look right now, AI is making headlines. From writing essays to generating product descriptions, tools like ChatGPT, Claude, and Gemini seem to have the answer for everything. So it's natural that people in resale have started asking: Why not just use an AI chatbot to figure out resale pricing?

At first glance, the idea sounds appealing. You type in What's a Louis Vuitton Neverfull Tote worth? and get back a confident answer. But dig deeper, and you'll see why relying on chatbots for resale pricing is misleading, and why understanding resale value requires a lot more than a quick scrape of online listings.

The resale market today isn't transparent. It's a black box of fragmented, messy information. And unless you solve that problem first, any pricing strategy will be built on shaky ground.

The Myth of "Just Checking Listings"

On the surface, resale pricing might look like simple comparison shopping: search for similar listings online, scan a few articles, and estimate a value. But that approach quickly breaks down for two reasons.

First, listings don't equal sales. Just because someone lists a bag at $2,500 doesn't mean it will sell at that price. Chatbots trained on public text don't capture sold listings, as e-commerce sites often don't display sold listings online, therefore, distorting the actual resale fair market values.

Second, the data itself is inconsistent and unreliable, especially when the data is coming from online forums or P2P marketplaces. Titles can be written differently across platforms, descriptions can be inaccurate or missing information, and photos may not even match the product title or description. In other words, the raw material that AI chatbots are pulling from is riddled with noise.

Without cleaning, organizing, and standardizing this information, asking an AI to give you a resale price is like asking it to solve a puzzle with missing and mismatched pieces.

Why the Resale Market is a Data Black Box

The resale industry is massive, with millions of items listed and sold every year, but it's also highly fragmented. Data is scattered across various offline consignment shops, peer-to-peer platforms, managed marketplaces, auction houses, and pawn shops.

Each source has its own quirks:

- Product names are inconsistent.

- Conditions aren't always clearly graded.

- Images can be mislabeled or misleading.

- Listings are often missing key details.

For merchants and platforms, this creates a fog. You can see pieces of the market, but never the full picture. And for chatbots trained on surface-level data, that fog is even thicker.

How Trendful Brings Clarity

At Trendful, we know that to bring real intelligence to resale pricing, we had to tackle the messy data problem head-on. That's why we built the Catalog & Pricing API, a system designed to cut through the black box and deliver clarity.

Here's how it works:

- We collect weekly sold resale listings from over 300 resale vendors.

- Then we clean and verify every listing and match it to our structured catalog of over 70,000 product references.

- We apply confidence scoring to filter out outliers and questionable data points.

- We then layer in condition-based pricing tiers, historical pricing trends, liquidity metrics, and time-to-sell insights.

The result?

Merchants, brands, and platforms get pricing intelligence that's not just a guess; it's grounded in real, cleaned, and structured resale data.

Putting AI Chatbots to the Test

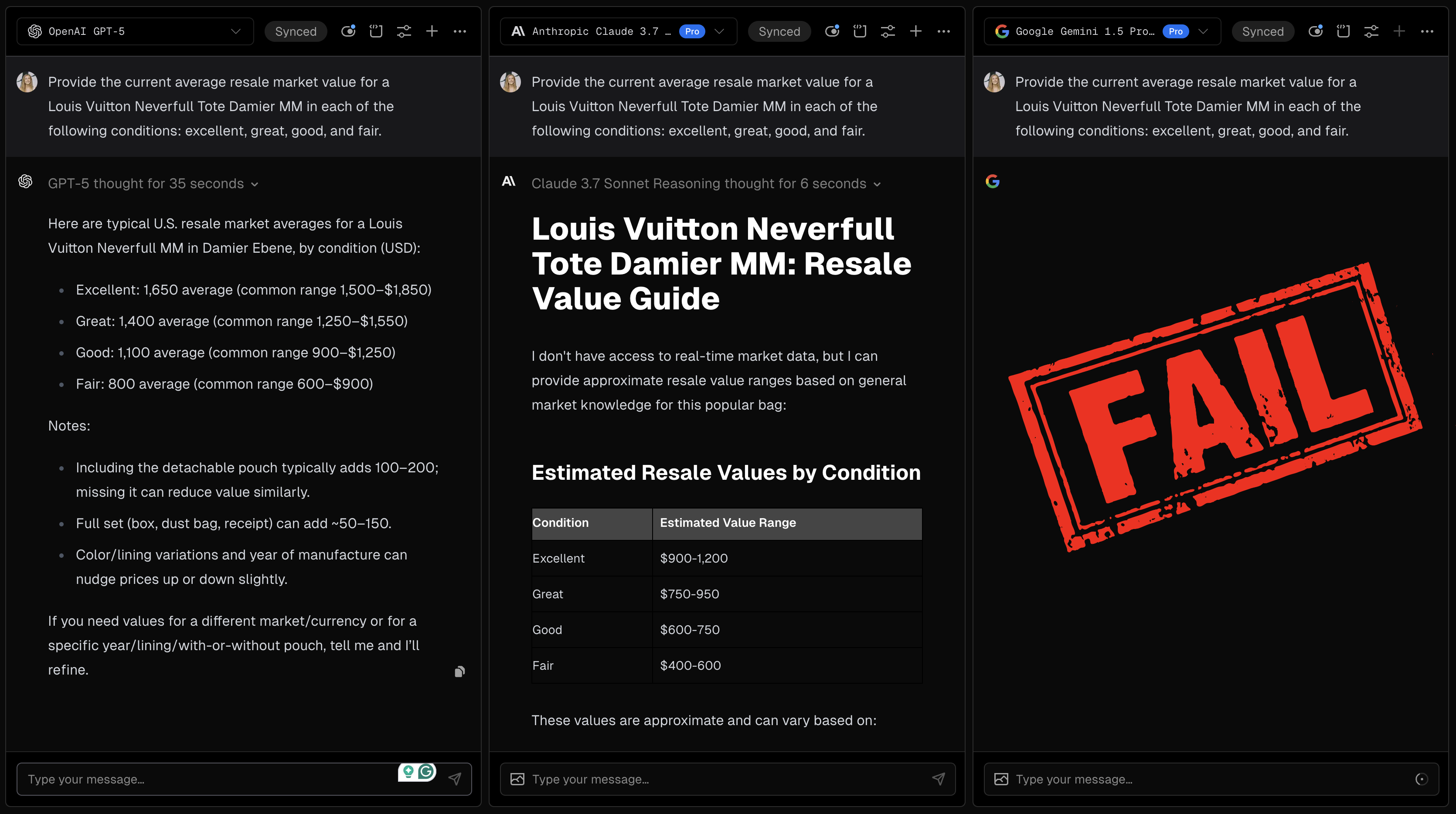

To see the real difference, we ran side-by-side comparisons across different AI models using real handbag models.

The results were eye-opening...

Take the **Louis Vuitton Neverfull Tote Damier MM (a very popular designer handbag and model). What is the current average resale value in excellent, great, good, & fair condition? :

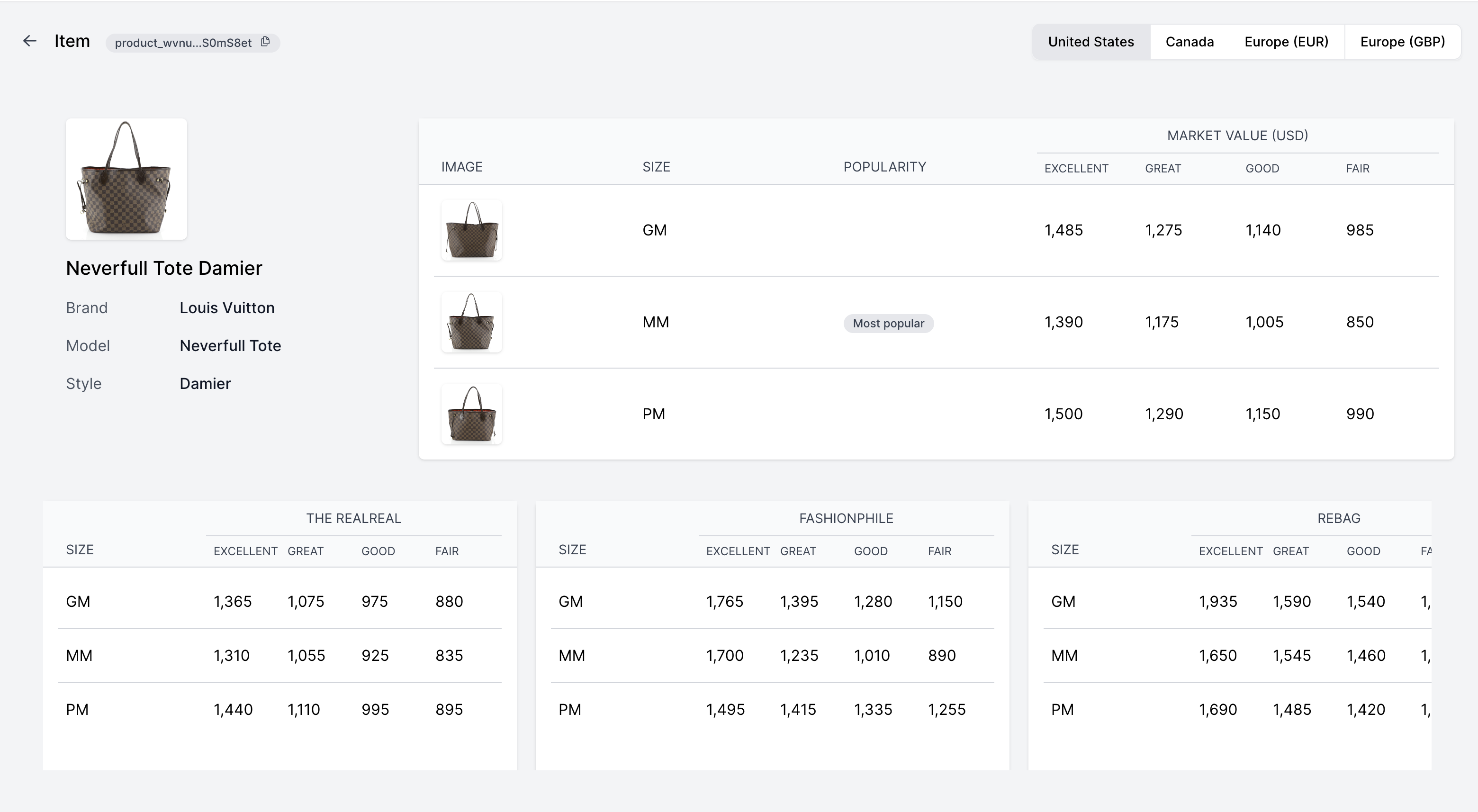

- Trendful's API: Based on verified sold data across 330+ vendors.

- ChatGPT: Overall, the response is more in range with sounding accurate. However, the ranges are still off, even for a popular bag.

- Claude: Consistently lower price ranges, undervaluing the item.

- Gemini: Wasn't able to even return an answer.

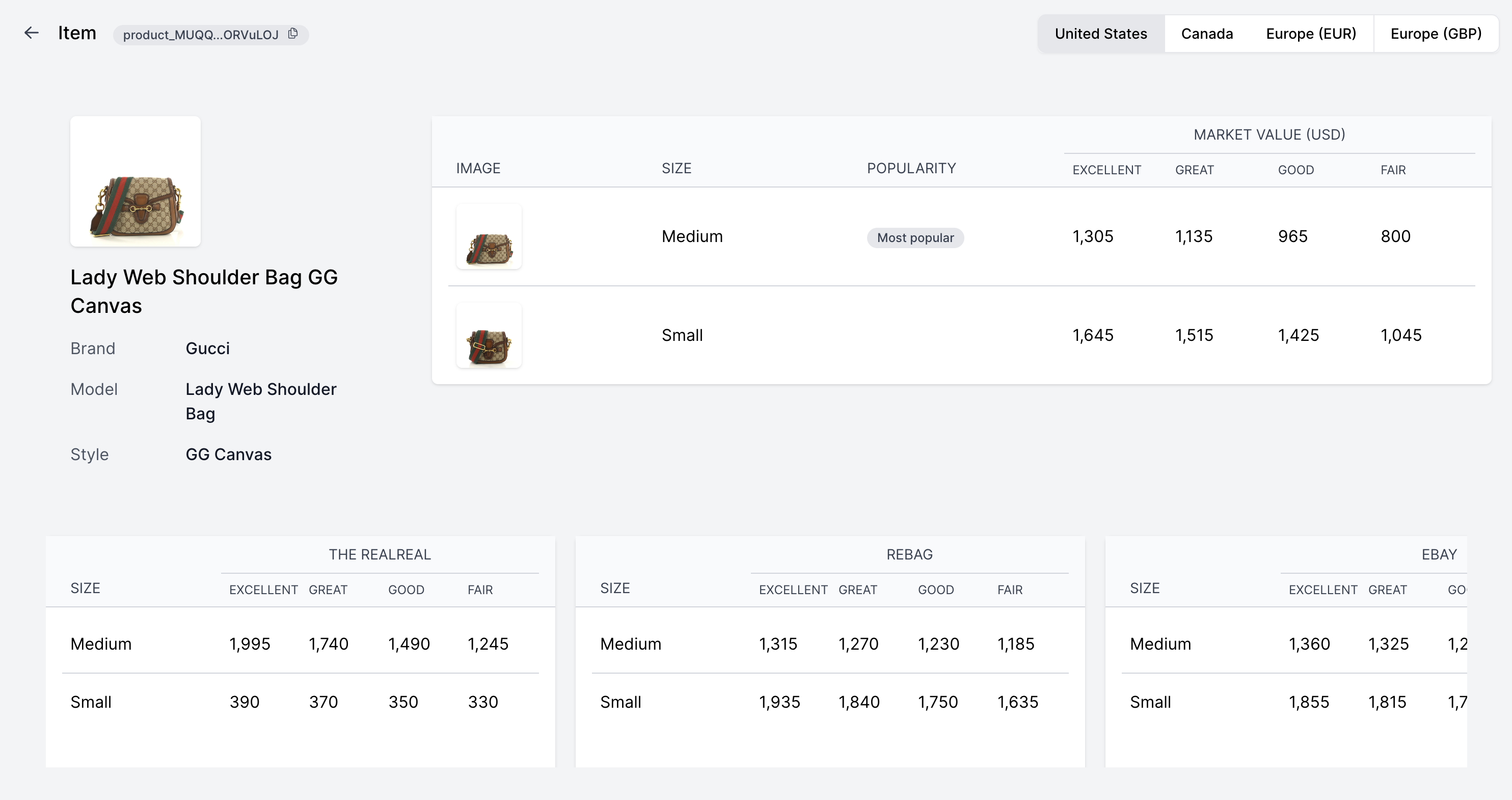

See above a screenshot for the same handbag with Trendful's fair market values based on size and condition. We collect, clean, analyze, and update prices weekly.

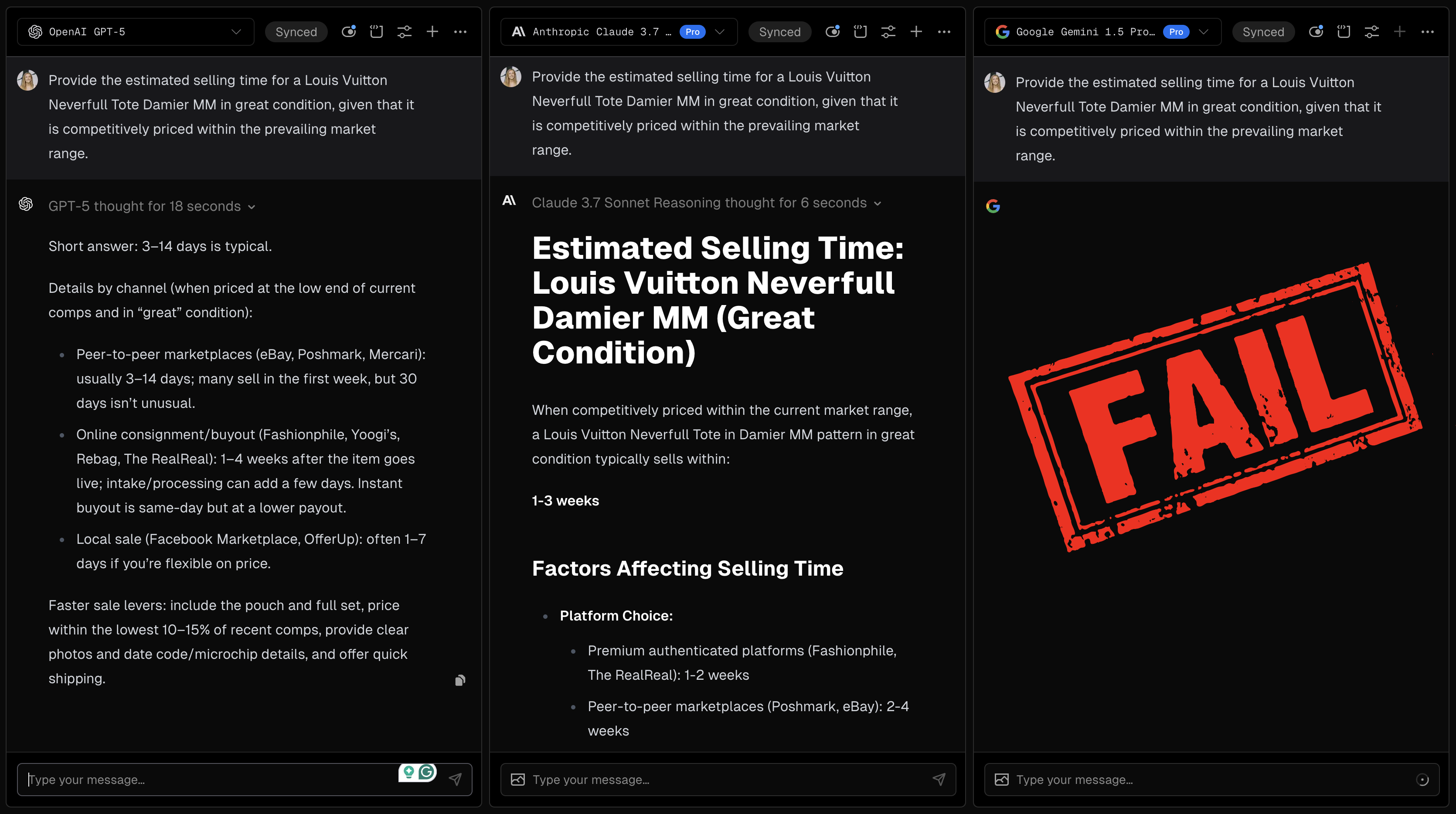

Now let's take the Louis Vuitton Neverfull Tote Damier MM and test the different models to see if they can give us an estimated time-to-sell.

- Trendful's API: On average, 17 days to sell. On managed marketplaces, 15 days to sell and 20 days on peer-to-peer marketplaces.

- ChatGPT: 3-14 days, more granularity than other AI models.

- Claude: 1-3 weeks, still a wider range compared to ChatGPT.

- Gemini: Again, wasn't able to even return an answer for time-to-sell.

An aspect about time-to-sell that ChatGPT gets wrong is that it estimates that P2P marketplaces will sell a Louis Vuitton Neverfull Tote Damier MM faster than a managed marketplace, while based on our 4 years of historical data, it is generally the opposite case.

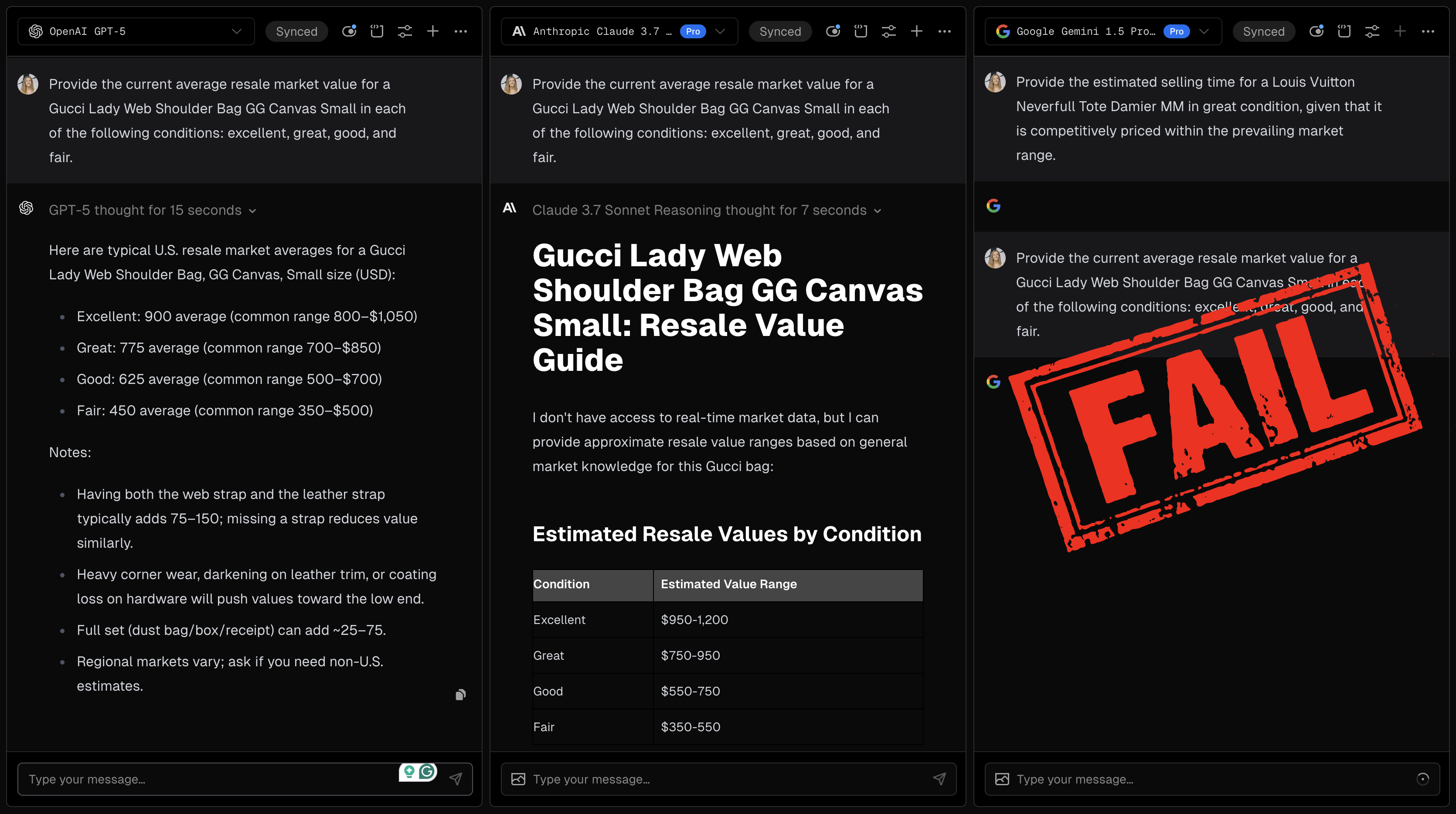

Then we tested a slightly less popular Gucci Lady Web Shoulder Bag GG Canvas Small. What is the current average resale value in excellent, great, good, & fair condition? :

- Trendful's API: Based on verified sold data across 330+ vendors.

- ChatGPT: For a slightly less popular bag, ChatGPT is unable to give accurate price ranges.

- Claude: Returned the same ballpark price ranges as it did for the Louis Vuitton Neverfull tote.

- Gemini: Again, wasn't even able to return an answer.

See above a screenshot for the same handbag with Trendful's fair market values based on size and condition. We collect, clean, analyze, and update prices weekly.

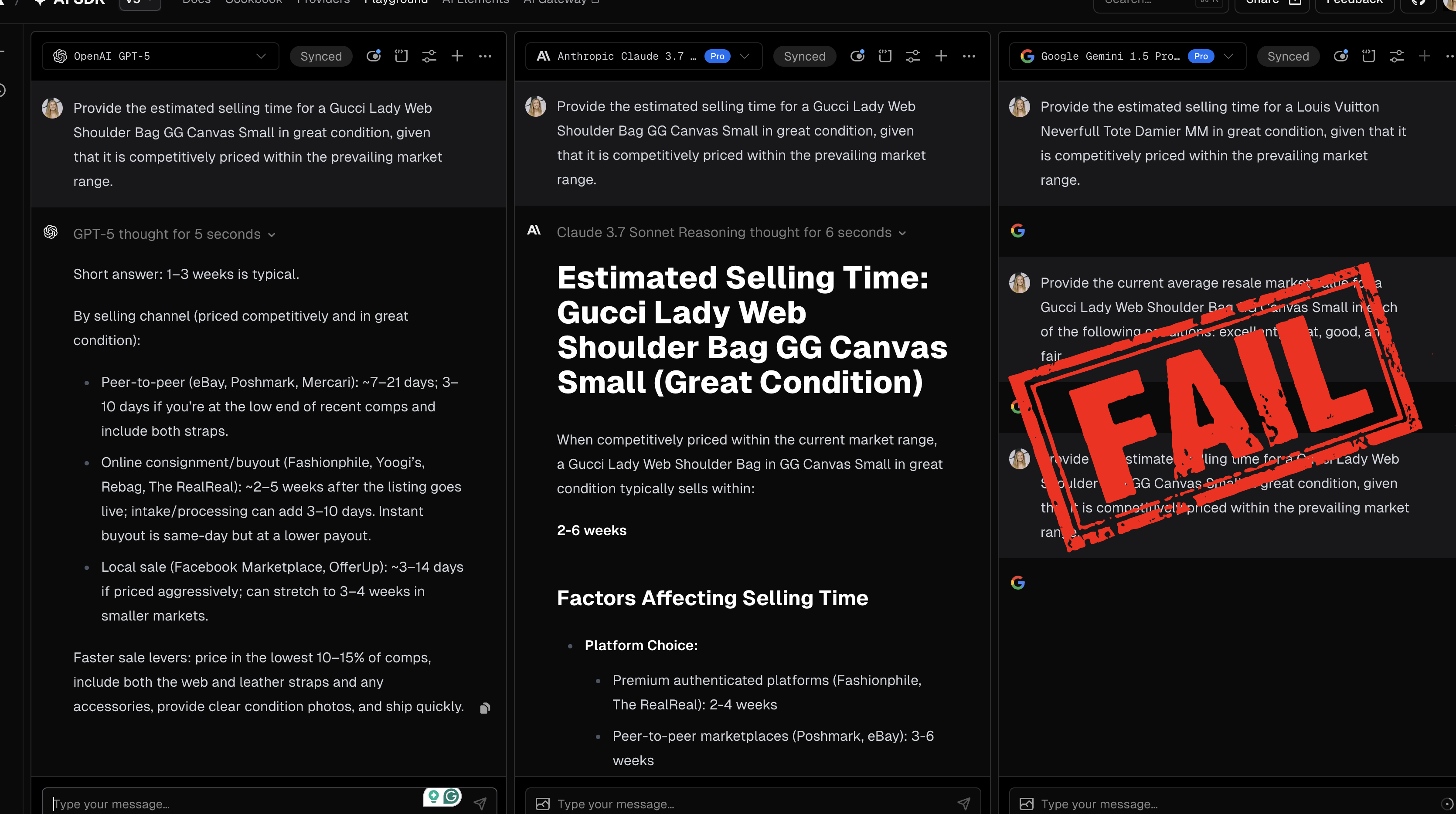

Next, let's take the Gucci Lady Web Shoulder Bag GG Canvas Small and test the different models to see if they can give us an estimated time-to-sell.

- Trendful's API: Average time-to-sell is 29 days. A managed marketplace would take on average 41 days, while a P2P marketplace would take around 19 days.

- ChatGPT: Says 1-3 weeks is typical.

- Claude: Gives a more blanket response of 2-6 weeks.

- Gemini: Like always, it is unable to return a response.

These tests show a clear pattern:

- Chatbots are giving guesstimate answers on what to value a specific handbag at. Sometimes, recycling general average price ranges for "luxury bags."

- They lack the ability to value items based on condition-based grading.

- They're inconsistent. Answers can change from one query to another on any given day.

When you are pricing one or two bags casually, that might seem "good enough." But at scale, hundreds or thousands of listings, those gaps compound into significant lost revenue.

Another aspect to consider is that AI chatbots are not tracking prices weekly, nor do they have access to historical data; their time-to-sell data should be taken with a grain of salt.

The Future: AI + Real Data

So does that mean AI has no role in resale? Not at all.

In fact, AI can be powerful when paired with the right data-backed foundation.

Imagine asking:

"Which Gucci bags under $1,500 are trending fastest in the US this quarter?"

An AI agent can interpret the question. But to give an accurate answer, it needs to pull from Trendful's live catalog and verified resale data, not just whatever it can find on the open web.

That's the future of what we are building: AI interfaces powered by structured, trustworthy resale intelligence. It's the best of both worlds: chatbot convenience with data you can actually rely on.

Closing Thoughts

Resale pricing isn't just about scanning listings or repeating what an article once said. It's about cutting through the black box of fragmented, messy market data and grounding decisions in verified reality.

AI chatbots can sound confident, but without the right data, they are just making educated guesses. Trendful solves the data problem first, so every price, trend, and insight we deliver is based on truth, not conjecture.

Because in resale, precision isn't optional.

Learn how Trendful's Catalog & Pricing API powers resale with intelligence: visit trendful.com.