Why Peer-to-Peer Resale Needs Better Pricing and Product Data - eBay, Vestiaire Collective, Poshmark

Introduction

Peer-to-peer resale has revolutionized the way people buy and sell secondhand fashion. Platforms like eBay, Poshmark, Vinted, and Vestiaire Collective have made it easy for anyone, from average day people to professional sellers, to participate in the resale economy. With just a few clicks, you can list an item, ship it, and get paid. For buyers, it’s become a popular way to discover everything from luxury bags to vintage streetwear at a fraction of the original price.

But while these platforms have lowered the barriers to entry, they’ve also introduced friction. Product discovery is often chaotic. Prices for similar luxury pre-owned items may vary dramatically, creating outliers in pricing. In addition, titles are vague, descriptions are inconsistent, and search results are often overwhelming. Whether you’re buying or selling, navigating peer-to-peer resale can be frustrating.

What Makes Peer-to-Peer Resale Different?

Unlike managed resale platforms like The RealReal or Fashionphile, which own or consign inventory, authenticate items, and handle pricing, peer-to-peer (P2P) marketplaces rely on users to do most of the work. Sellers upload their own photos, write product descriptions, set prices, and manage communication with buyers. The platform typically steps in to facilitate payments or generate a shipping label; however, that’s usually where its involvement ends. You do have some instances of platforms that help with authentication, like with Vestiaire Collective, for example.

This model works well for the average day people selling and offers incredible reach and visibility for resale businesses. But it also means there’s very little consistency across listings. Two sellers may list the same handbag (brand, model, style, color, condition, etc.) at wildly different prices, using completely different terminology (naming conventions). One also might include detailed information about the condition and authenticity, while the other offers only blurry photos and a vague description.

The Buyer Experience: Access Meets Friction

On the buyer side, peer-to-peer platforms offer some real advantages. The inventory is broad and constantly changing. You can often find rare or discounted items at discounted prices. Many platforms let you negotiate, message sellers directly, or bundle items for additional savings.

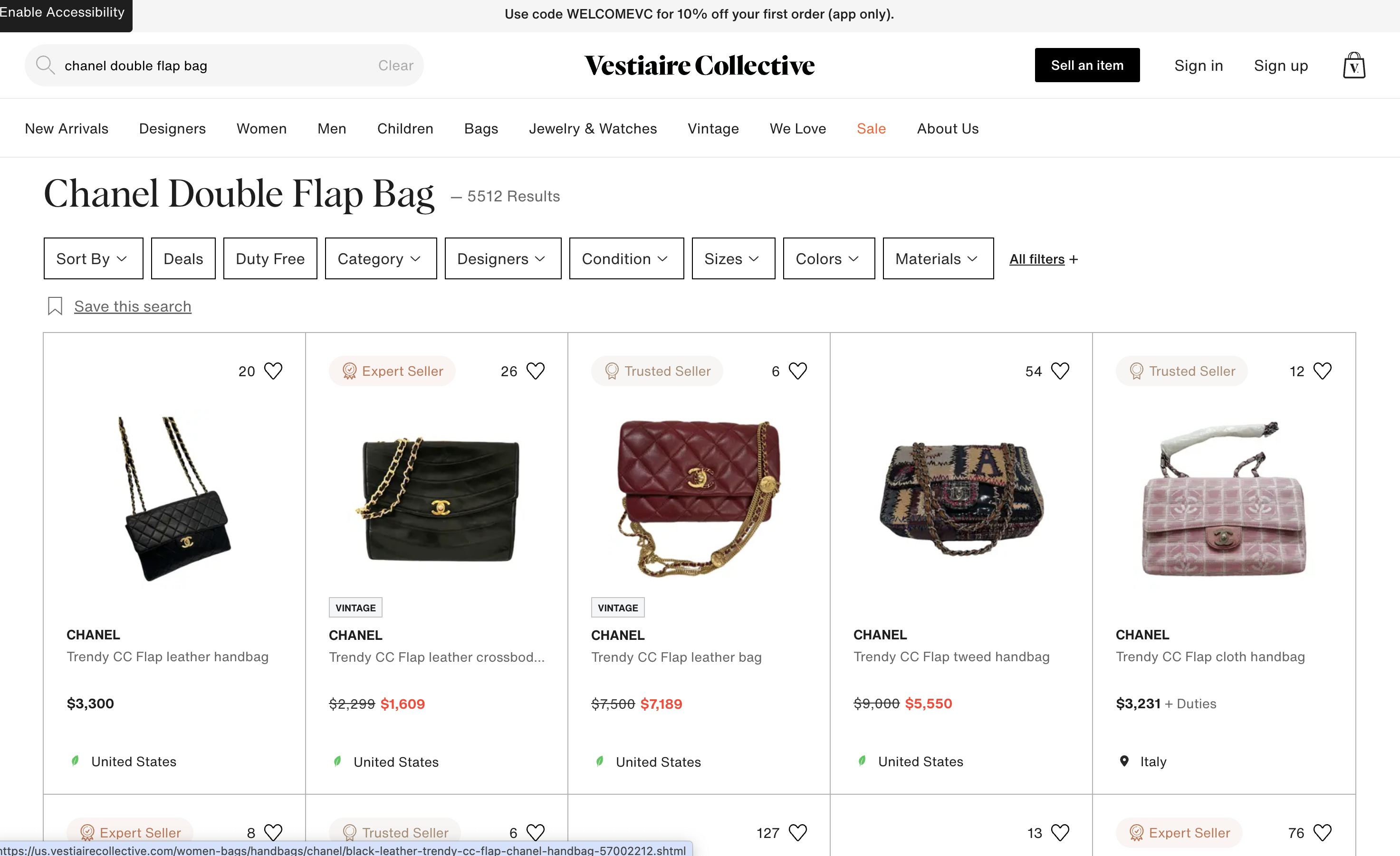

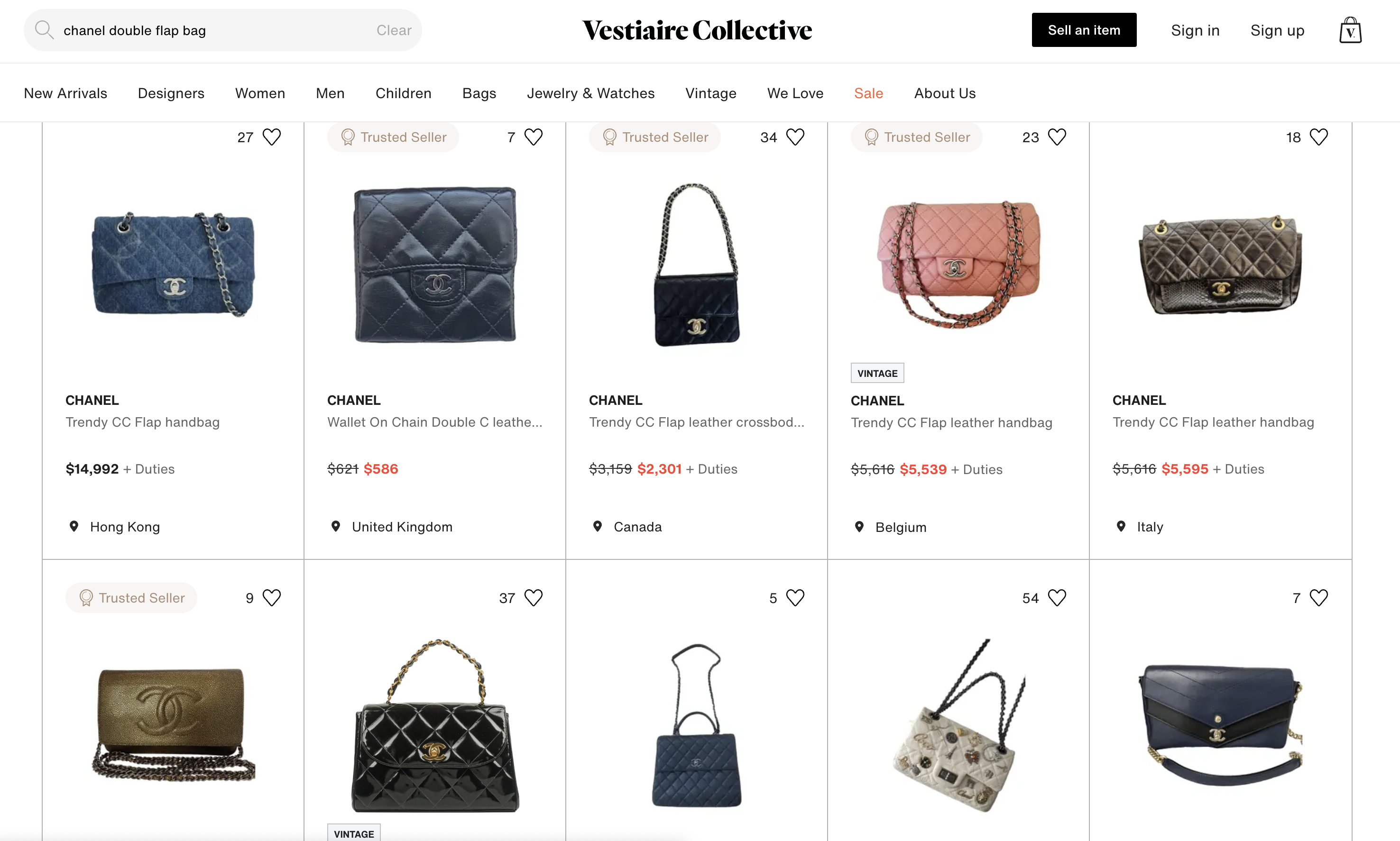

But the experience isn’t always smooth. Search can feel chaotic. Without standardized product names or categories, the same keyword might return hundreds of irrelevant results. For example, the search starts to get messy when you type in “Chanel Double Flap Bag” into the search. Let’s see what the search returns when doing that exact search on Vestiaire Collective today:

You can see that the search returns you Chanel bags; however, it returns you a mix of different models and styles that are not necessarily the “Chanel Double Flap Bag.”

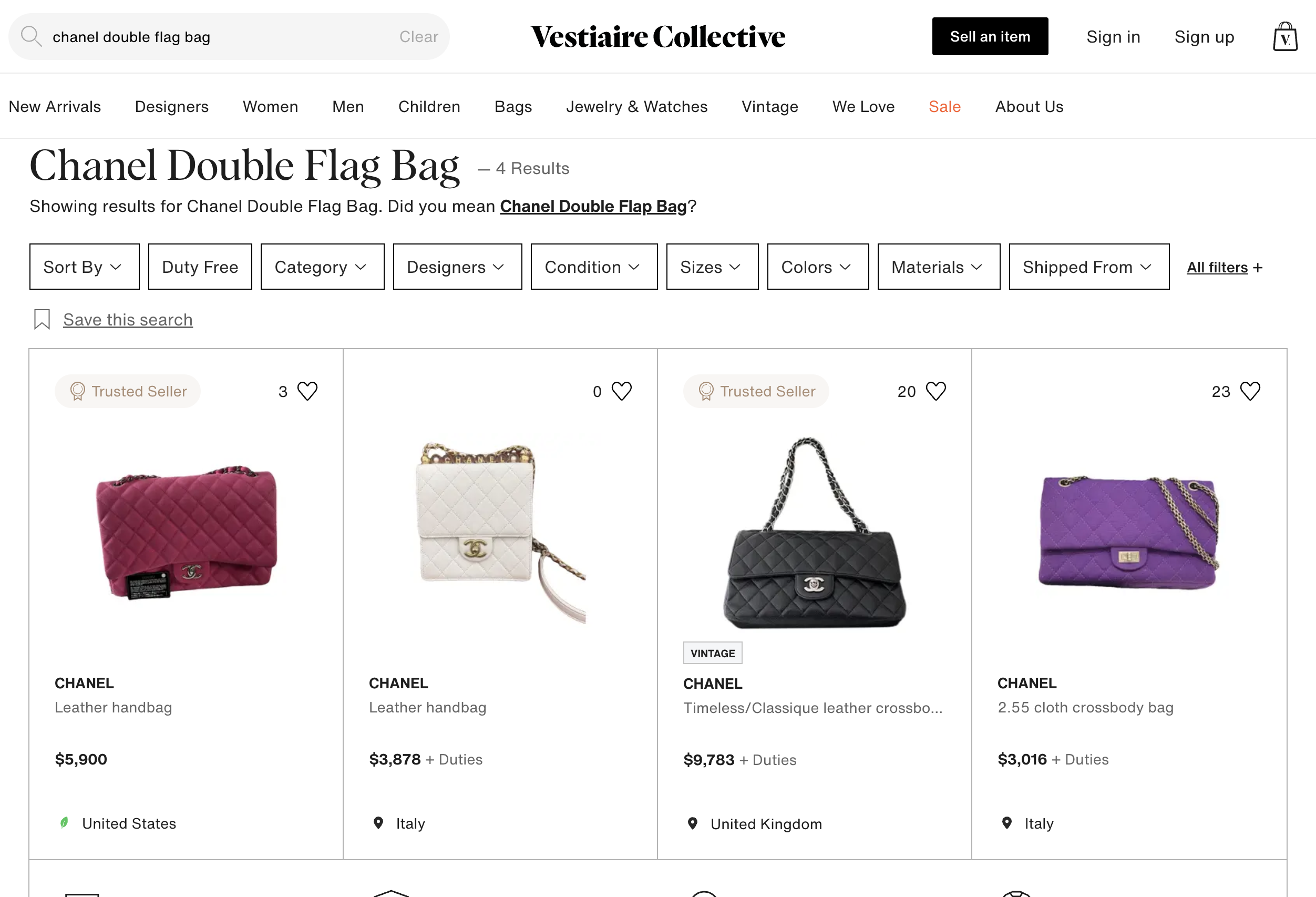

Many platforms are also not typo-tolerant, which means small errors in search queries can lead to missed inventory and missed sales.

For example, on Vestiaire Collective, if you search for “Chanel Double Flag Bag” instead of “Chanel Double Flap Bag,” only 4 listings appear. That’s not because the inventory isn’t there. It’s because those 4 sellers accidentally wrote “Flag” instead of “Flap” in their listing. Not only does this make it difficult for buyers to find what they want, but it also hurts sellers. Their listings become nearly invisible due to a simple type during the manual upload process.

Reference link: https://us.vestiairecollective.com/search/?q=chanel+double+flag+bag

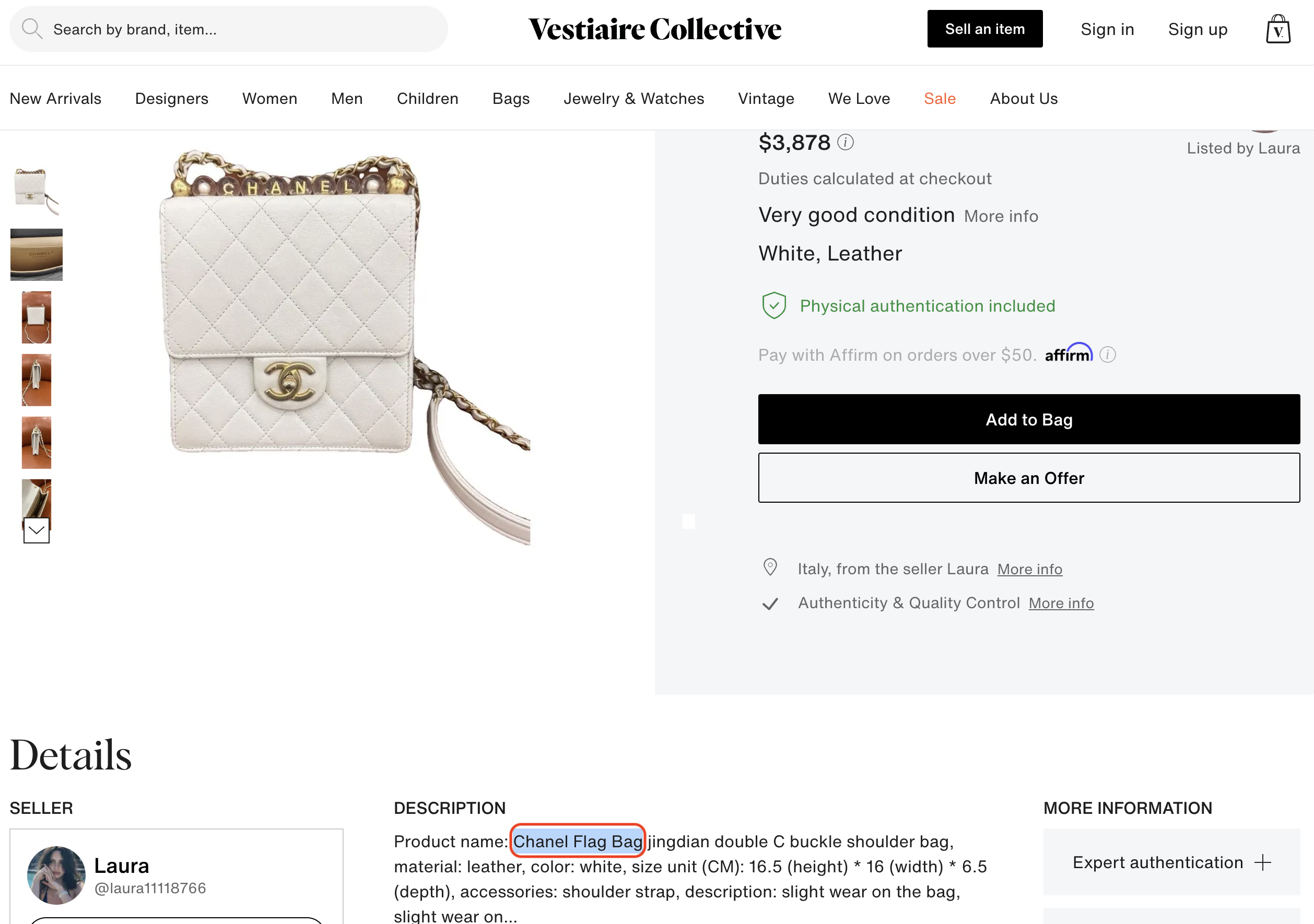

Reference link: https://us.vestiairecollective.com/women-bags/handbags/chanel/white-leather-chanel-handbag-57186778.shtml

This highlights a deeper issue: human error in the listing process is inevitable, especially when everything from product naming to pricing is left up to the seller. Without tools to catch and correct these inconsistencies, platforms risk undermining both trust and transaction volume.

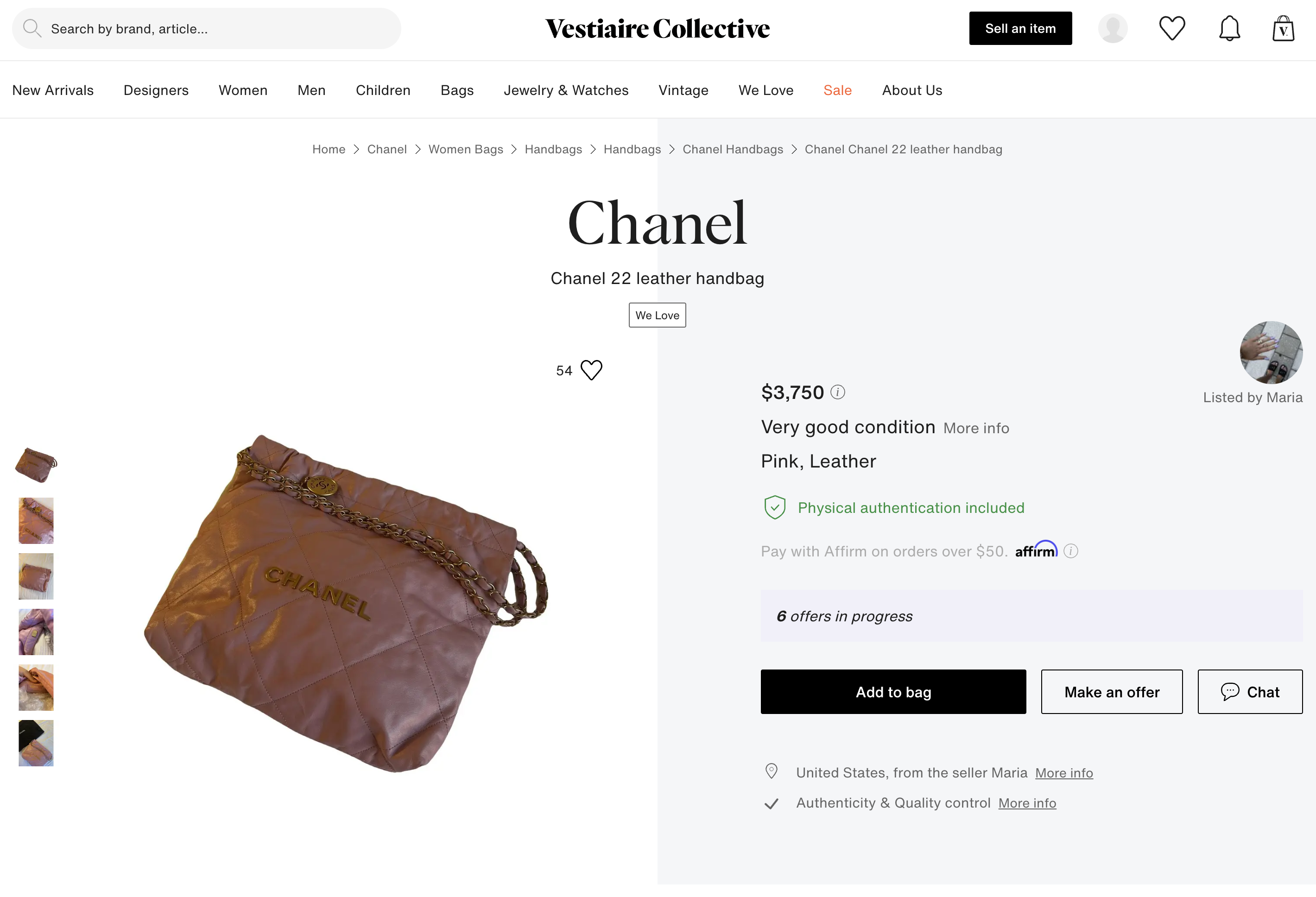

Here’s a real-world comparison from Vestiaire Collective:

Reference link: https://www.vestiairecollective.com/women-bags/handbags/chanel/pink-leather-chanel-22-chanel-handbag-56827598.shtml

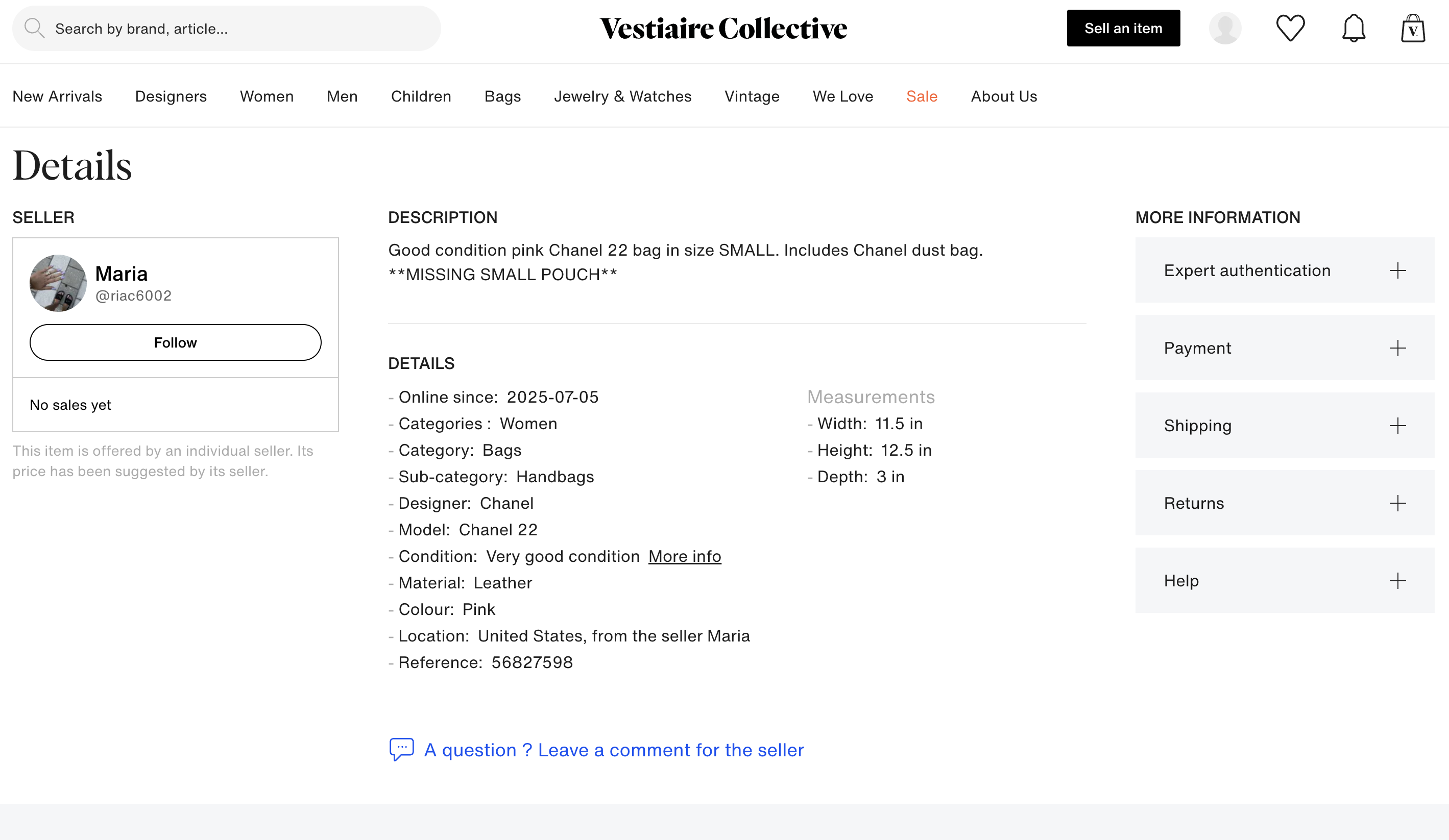

Before structured data:

Title: Chanel 22 leather handbag

Price: $3,750

Description: Good condition pink Chanel 22 bag in size SMALL. Includes Chanel dust bag. MISSING SMALL POUCH

After structured data:

Title: Chanel 22 Chain Hobo Quilted Calfskin Small

Price: $4,900

Description:

This is an authentic CHANEL 22 Chain Hobo Bag in Small Pink Quilted Calfskin, offered in very good condition. Crafted from supple pink shiny calfskin leather, this stylish and modern hobo features Chanel’s signature diamond quilting, gold-tone hardware, and a leather-threaded chain-link shoulder strap. The front showcases the iconic interlocking CC logo. The open top with snap closure reveals a twill-lined interior with a single slip pocket.

Please note: the small removable interior pouch is missing.

Includes original Chanel dust bag.

Features:

- Style: Chanel 22 Chain Hobo

- Size: Small

- Color: Pink

- Condition: Very Good

- Material: Shiny Quilted Calfskin Leather

- Gold-Tone Hardware

- Chain-Link Shoulder Strap

- Snap Closure at Top

- Twill Fabric Lining

- Single Interior Slip Pocket

- Does not include small interior pouch

Better product data, paired with typo-tolerant search and enriched metadata, doesn’t just improve SEO. It ensures that listings are actually discoverable - and sellable.

The Seller Experience: Flexible but Hard to Scale

For sellers, especially small businesses or power users, P2P platforms offer flexibility and reach. There’s no need to build your own storefront or manage an e-commerce backend system. It’s a low barrier to entry; anyone can sign up, list a few items, and start selling online almost immediately. Listing on P2P platforms allows sellers to have easy visibility or discoverability for items they are selling, tapping into the traffic of the marketplace that they normally wouldn’t have access to right out of the gate if they had listed just on their own website. You control your listings, your pricing, and your customer interactions. Some even use these platforms as their primary sales channel, building loyal followings through bundles, live sales, or social features.

Selling at scale, however, quickly reveals some limitations. Tools like List Perfectly and Vendoo help with cross-listing inventory across platforms, and for example, Vestiaire Collective offers bulk listing features for professional sellers. But even with these tools, many challenges remain. Listings still require manual input. Product titles and descriptions are inconsistent. Pricing varies wildly – even for the exact same item.

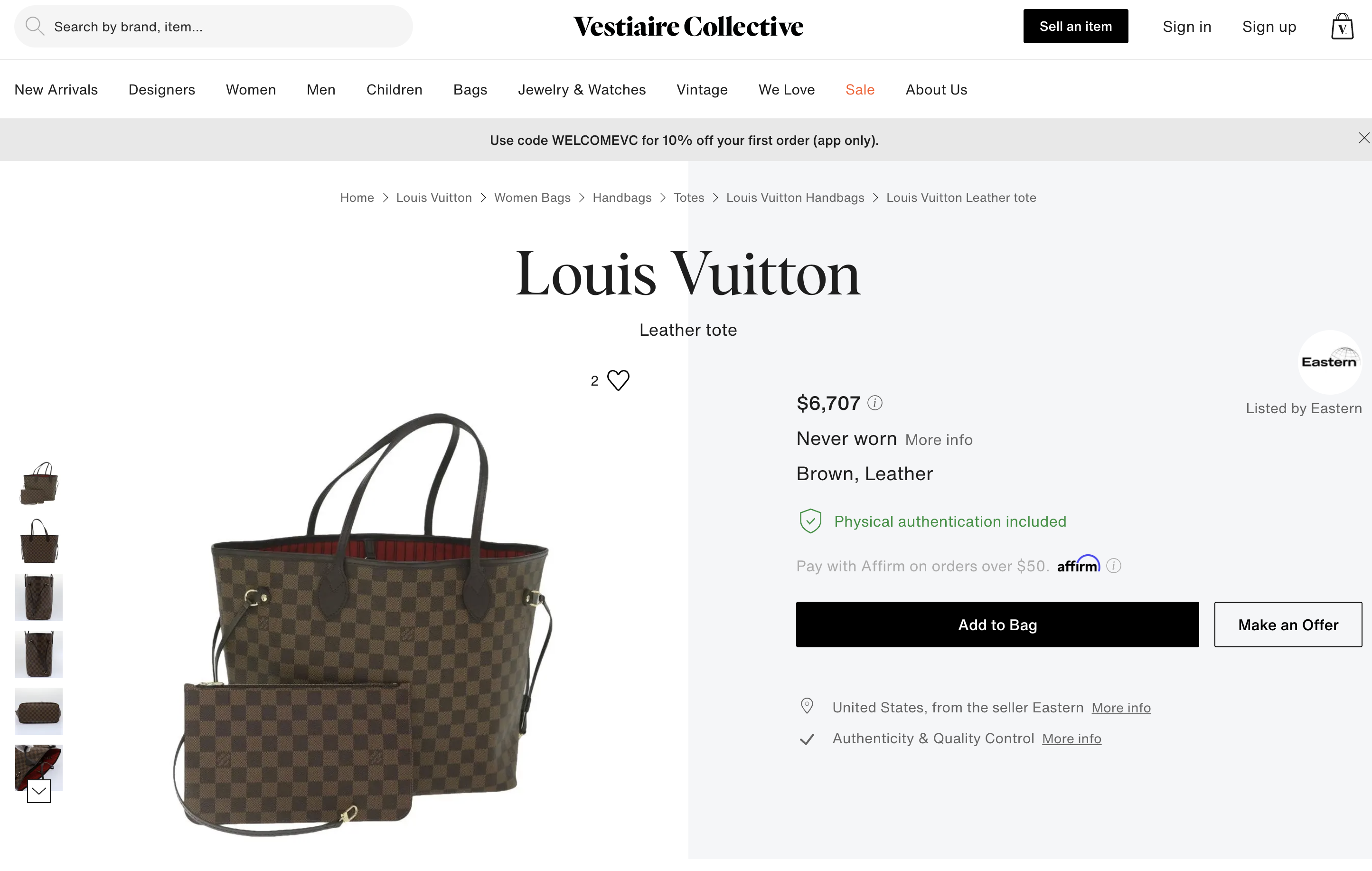

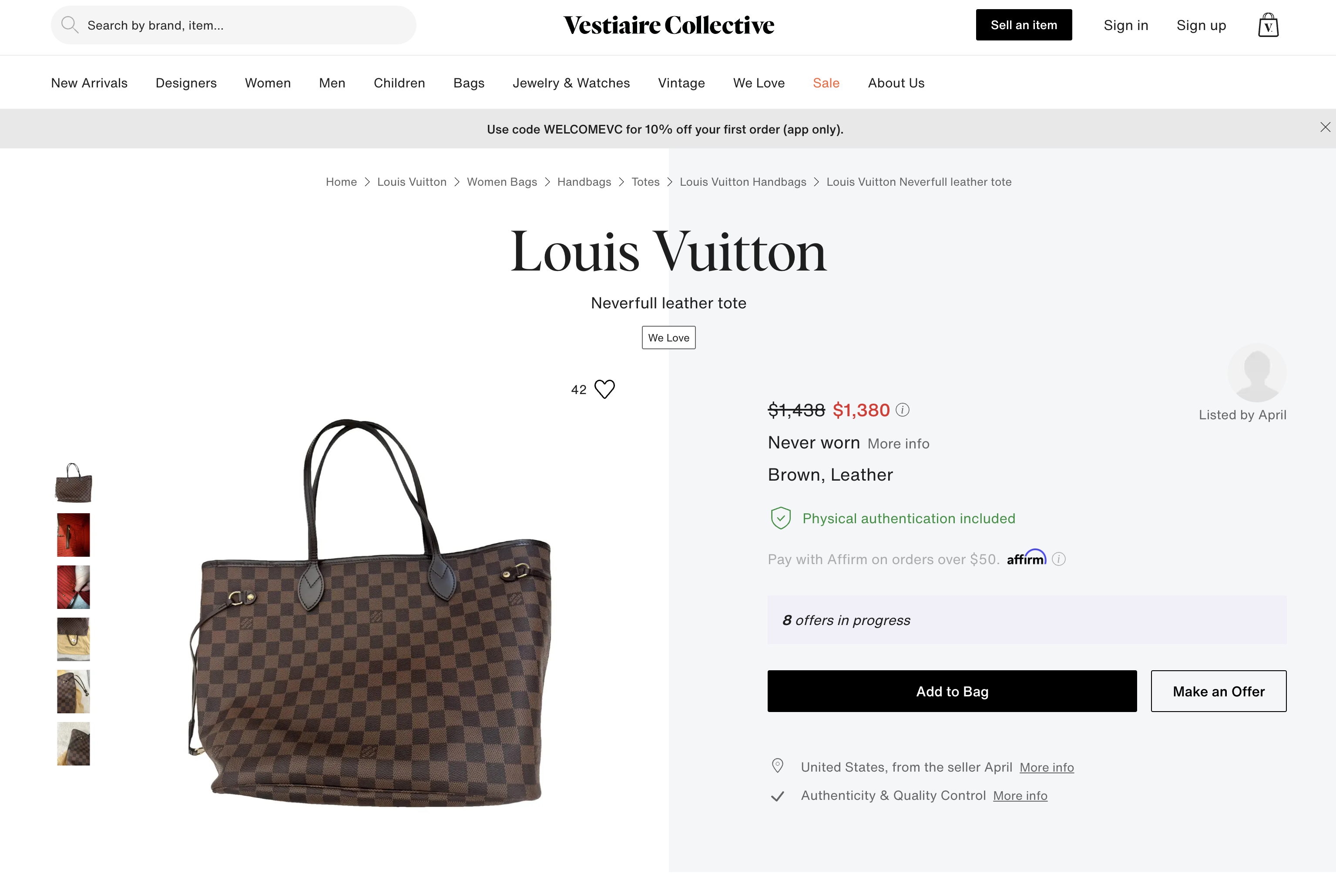

Take the two current listings on Vestiaire Collective for a Louis Vuitton Neverfull Tote Damier MM:

Reference link: https://us.vestiairecollective.com/women-bags/handbags/louis-vuitton/brown-leather-louis-vuitton-handbag-54087488.shtml

Reference link: https://us.vestiairecollective.com/women-bags/handbags/louis-vuitton/brown-leather-neverfull-louis-vuitton-handbag-56961142.shtml

Both Louis Vuitton bags have the same condition grading on the site; however, one is listed at $1,380 USD and the other at $6,707 USD.

Therefore, while sellers have the capabilities to cross-list or list in bulk, it doesn’t solve the underlying issues that impact discoverability and sell-through: inaccurate pricing, lack of standardization, and limited market data.

The Missing Piece: Structured Data and Smarter Tools

At the core of these challenges is a lack of structured product and pricing data. Without consistent naming conventions, historical pricing benchmarks, or demand signals, both buyers and sellers operate in a fragmented and inefficient ecosystem.

This is where technology can make a significant impact.

With structured product data, sellers could receive real-time pricing suggestions based on brand, model, style, condition, popularity, and actual sales data. Listings would become standardized automatically, turning vague titles into rich, searchable product names. Enhanced descriptions would improve SEO and drive higher visibility. And resale platforms could use real-time sell-through rates and trend data to guide what to surface and promote.

For marketplaces, this isn’t just about better UX. It’s about empowering sellers to succeed and creating an infrastructure that supports scalable growth.

How the Catalog API Works Behind the Scenes

Trendful’s Catalog API was designed specifically to bring structure and intelligence to resale listings. It works by taking a seller’s input, such as a product name, brand, or image, and matching against a structured reference model built from millions of product and pricing data points.

From there, the API returns enriched data: product titles, categories, condition, market-based pricing, and even optimized descriptions. It also generates trend signals and sell-through rates insights, so platforms or power sellers can know which items are likely to move quickly at what price.

Technically, it’s built to integrate seamlessly into resale platforms, listing services, or internal tools. And the more it’s used, the smarter it gets, continually learning from new sold listings and pricing patterns across the market.

What if a Platform Already Has a Pricing Engine?

Many marketplaces already have some form of pricing logic or internal valuation models. The Catalog API isn’t designed to replace those systems – it enhances them.

Most internal tools rely solely on data from that specific platform. That works well for closed-loop environments, but resale operates across a fragmented ecosystem. Trendful’s API brings in broader market intelligence, drawing from cross-platform data and pricing trends. That context helps sellers avoid vanity pricing, identify underpriced opportunities or overpriced outliers, and create more consistent listings without losing control.

Building the Infrastructure Resale Deserves

Peer-to-peer resale has opened the door for anyone to participate in the circular economy. That accessibility is what makes it so powerful. At the same time, it also leads to inconsistencies that make it harder for the market to function efficiently.

We don’t believe the solution is to restrict listings or gatekeep who gets to sell. Instead, the solution is to offer smarter tools that help everyone, whether they are first-time sellers or multi-channel merchants, list faster, price better, and sell with more confidence.

As more platforms enter the resale space and more inventory comes online, the marketplaces that prioritize product data and structured infrastructure will have a competitive advantage. Peer-to-peer resale does not need more listings. It needs better listings.

This article is based on insights shared in Episode 11 of “The Resale Stack,” hosted by Jackie de la Parte and Mailys Rabot. To learn more about how structured product data is reshaping resale, watch the full episode on YouTube.